We use Authorized User tradelines to enhance your credit:

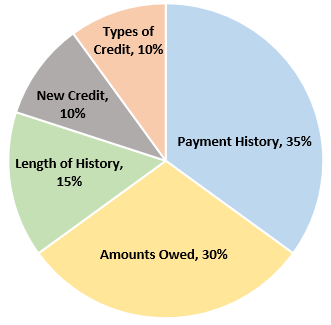

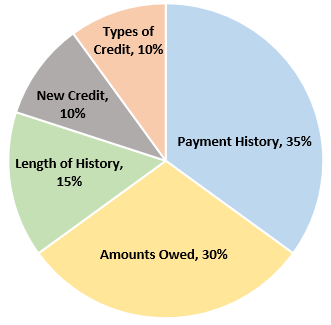

First, what is a tradeline? A tradeline is the industry term for any credit account that appears on your credit report. We evaluate your credit reports to see if tradelines will help; if so, we get your data, submit it to the lender (e.g. Chase, Bank of America, Discover, etc) and the lender reports the data to the credit bureaus. When this data posts, your credit will update utilization ratios, age and payment history for each tradeline posted. What makes tradelines so effective? Glad you asked. First, have a look at how the 3 credit bureaus evaluate your score.

Tradelines provide positive data on three evaluation factors:

Payment History,

Amount owed, and

Length of History. These factors comprise as much as 60% of your credit score. When we post an authorized user tradeline, you are benefiting from the age of the tradeline, the availability of the limit (always utilized under 10%), and the perfect payment history.